Metals markets to move into surplus — report

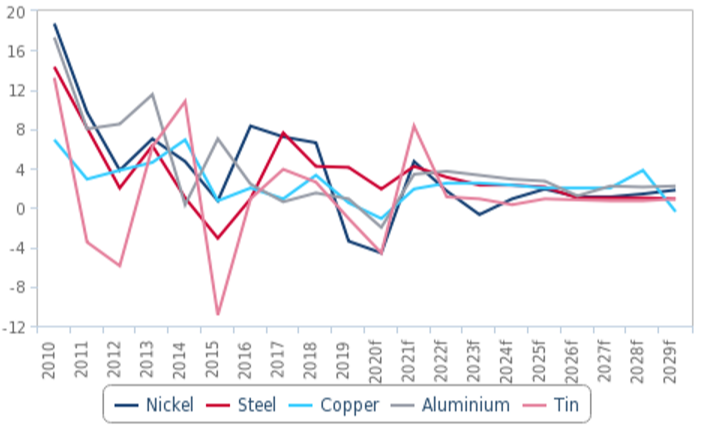

Most metals markets will move into surplus in 2020 due to the covid-19 pandemic, according to Fitch Solutions latest market report.

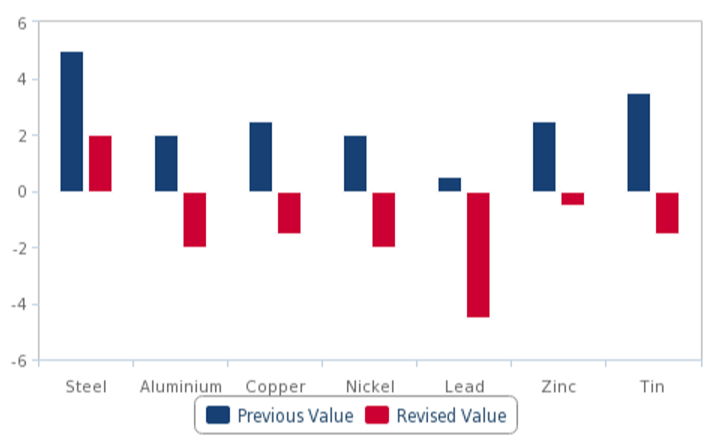

The research agency has revised down its forecasts for both consumption and production of metals for a number of countries over recent weeks.

“Operational hurdles as a result of covid-19, especially for smelters located in countries where governments ordered lockdowns, and voluntary production curtailments as a result of the collapse in metal prices will result in lower 2020 metal production compared to our previous forecasts,” Fitch analysts say.

The firm expects that global recession in 2020 will hamper metals demand as end-use sectors, including autos, construction and home appliances enter a lull.

Copper

Fitch expects global copper production to grow by 0.6% y-o-y in 2020, a steep drop from the previous forecast of 1.9% y-o-y growth.

China copper production declined by 2.5% year-on-year in March to 771,000 tonnes, according to the National Bureau of Statistics, due to coronavirus disruptions.

While the country’s lockdowns have been lifted, Fitch expects supply chain disruptions affecting copper concentrate imports, as lockdowns in Latin America tighten the seaborne market, to hamper Chinese refined copper production further in Q2 2020, before a slight recovery in H2 2020.

Fitch expects global copper consumption to decline by 1.1% y-o-y in 2020, compared to previous forecast of a 1.6% y-o-y growth.

THE AGENCY REVISED DOWN 2020 COPPER CONSUMPTION GROWTH FORECASTS FOR THE TWO LARGEST CONSUMING COUNTRIES, CHINA AND THE US

The agency revised down 2020 copper consumption growth forecasts for the two largest consuming countries, China and the US, from 2.5% and 1.5% growth y-o-y to declines of 1.5% and 4.5% y-o-y, respectively.

“As a result, we now expect the global copper market to fall into a large surplus of 344kt in 2020, compared to a deficit of 63kt in 2019. As the global economy recovers and so does copper demand in 2021, we expect the surplus to narrow to 162kt before shifting into a deficit of 51kt again in 2022,” Fitch says.

Aluminum

Fitch expects global aluminum production to grow by 1.2% y-o-y in 2020, less than half the previous forecast of 3.0% y-o-y growth.

Globally, due to covid-19, the agency expects some disruptions to aluminum production and revised down forecasts across a number of countries including China, India, the US, and Germany.

In March, Norsk Hydro announced that it will reduce and halt the production of some aluminum products.

In Germany, ST Extruded Products Group closed three aluminum smelters.

RUSAL also announced that it will delay the ramping up of additional capacity at the Taishet Smelter in Siberia from H220 to H121.

Fitch expects global aluminum consumption to decline by 2.0% y-o-y in 2020, compared to the previous forecast of a 1.5% y-o-y growth.

The company has revised down 2020 consumption forecasts for China, the US, and India mainly, from y-o-y growth rates of 2.0%, 1.5% and 16.0% to y-o-y declines of 2%, 5% and 8%, respectively.

“As a result, we now expect the aluminum market to be in a surplus of 3mnt in 2020 compared to 1mnt in 2019. Similar to copper, we expect the surplus to narrow to 2.5mnt by 2021 as the global economy improves.”

Nickel and tin

The nickel and tin markets will also suffer due to the economic effects of covid-19.

“We have revised downwards our 2020 global production growth forecasts for both nickel and tin from 0.3% and 6.3% y-o-y previously to -0.3% and -2.6% y-o-y, respectively,” Fitch says.

“In regards to tin, production cuts among leading producers, whether through voluntary ramp downs due to the low tin price environment or through government mandates, have placed a dent on refined tin production over recent months.”

Fitch revised down its 2020 forecasts for nickel and tin consumption growth from -2.7% and 5.7% y-o-y previously, respectively, to a decline of 4.6% y-o-y each.

The agency forecasts combined consumer electronic sales across 58 markets globally to contract by 0.6% y-o-y in 2020 compared to a 3.4% y-o-y growth forecast in early January.

“A decline in consumer electronic sales will undercut the incentive for consumer electronics manufacturers to maintain previous output levels thus weighing on demand for tin.”

Fitch’s revised forecasts now show the tin market balance to be zero in 2020, and the nickel market to be in a surplus of 38kt, after both markets registered deficits in 2019 of 8kt and 58kt, respectively.

“While the nickel surplus will reduce in 2021 to just 4kt as stainless steel production gears up, the tin market will see a surplus of 4kt as it will take longer for consumer spending to pick up.”

Source: Mining.com